Being a young adult can be one of the most exciting phases in life. A sense of freedom comes from making your own decisions, starting a career and/or family, and finally having a decent paycheck! With all the new excitement, retirement might be the last thing on your mind. The reality, however, is that your current actions or inactions can greatly impact how your retirement will look years down the road.

Save and Save Early

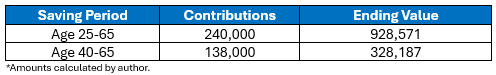

If there is a magic bullet in the investing world, it is the power of compounding. The following table compares investing $500/month for 40 years versus the same amount for 25 years. The assumed rate of return is 6%, compounded annually. Starting earlier results in an ending balance that is 2.8x greater!

One will likely save more as their income rises with age and experience, but establishing a habit of saving early on is the critical point. There will always be nicer houses and nicer cars that will attempt to lure you from your savings plan. Automating your savings through direct deposits can help keep you on track.

Retirement Savings Accounts

Once you have made the decision to save, the next step is to determine where to save. There are multiple types of retirement accounts, each with their own benefits.

Defined Contribution Plans

These employer-sponsored plans allow individuals to have savings deducted directly from their paycheck. These plans include 401(k), 403(b), and Thrift Savings Plan accounts, depending on whether the employer is a for-profit, non-profit, or government entity.

Benefits include:

- Your contributions are usually made with pre-tax money, reducing the current year’s taxable income.

- Savings will grow tax-deferred until you take the funds out in retirement.

- Many employers match a portion of your savings – make sure to maximize that!

- Your account is portable, meaning you can take them with you when you change employers.

- There is typically a diverse menu of investment options to meet your needs.

- Contribution limits are high – In 2024, the limit is $23,000 for employee contributions and $69,000 for combined employer/employee contributions.

- Roth options are often available, meaning you pay the income tax on your contributions immediately, but then the balances grow tax-free. This is a great option for young adults as your income tax bracket is likely lower than it will be later in life.

Individual Retirement Accounts (IRAs)

IRAs are established by you individually. There are several types of IRAs, including Traditional and Roth IRAs (similar to Roth 401(k)s above), Spousal IRAs when one spouse has limited or no earned income, SEP IRAs for self-employed individuals, and SIMPLE IRAs for small business and self-employed individuals.

Some characteristics of IRAs include:

- Tax-deferred growth, just like defined contribution plans.

- Investment flexibility – very wide array of investment options at brokerage firms.

- Rollover functionality, meaning you can roll 401(k) balances into your IRA when you change jobs.

- Smaller contribution limits – 2024 Traditional IRA limit is $7,000 for those under 50 years of age.

- Withdrawals before age 59 ½ are subject to taxes and penalties.

Choosing Your Investments

Ok, you determined your savings plan, opened your retirement accounts – now it’s time to roll the dice, right?

Many people believe that the trick to early retirement is picking the next hot investment. I hate to spoil the fun, but boring is usually better. It’s about time in the market (as opposed to timing the market) and consistent savings patterns. Also, studies suggest that over 90% of your investing results are determined by your mix of stocks and bonds. Security selection plays a very minor role in a properly diversified portfolio.

When you are young and have many years until retirement, you will want to have more growth-oriented assets like stocks. Within retirement plans, there are usually Fund-of-Funds (FOF) that provide diversification with one selection. Target-date funds are a good example of this. Keep it simple, don’t make big changes due to market fluctuations, and let time do its thing. If you want excitement, take $20 to the casino. The purpose of your retirement account is not excitement.

Putting It All Together

Saving early and consistently can be the most important factor in a successful retirement plan. Automatic payroll deductions allow you to “pay yourself first.” Funds may be tight as a young adult, but your discipline will be rewarded. Create a diversified portfolio and let time work for you. Investment portfolios are like bars of soap – the more you touch them, the smaller they get. Trying to pick the best investment will likely cost you significantly versus owning the broad market. Finally, you may not have much money early on, but you hopefully have an abundance of time. Start today!

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.