Knowledge Center

Emotionally Intelligent Investing

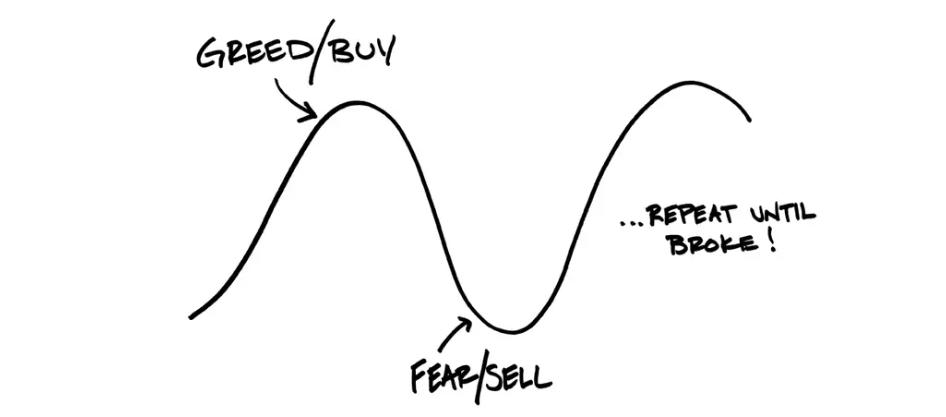

Most investors, even professionals, woefully underperform the indexes. Ironically, attempts to “beat the market” sabotage long-term results, driven not by analytical errors but by emotional ones. Fortunately, strategies exist to both sidestep these pitfalls and leverage them to your advantage.

Striking Balance in the Risk Equation

Whether you’re a retiree enjoying the fruits of your labor or a business owner steering through the complexities of entrepreneurship, risk affects us all, and it’s crucial to find the balance between emotional resilience and financial stability.

When Markets Give You Lemons: Tax-Loss Harvesting

We’ve all heard the saying, “When life gives you lemons, make lemonade.” That same attitude can serve investors well when managing their non-retirement investment portfolios.

The #1 Challenge Facing a Growing Small Business

Why do some small businesses springboard their growth into success while other’s plateau? Let’s break this down to help you understand where you’re at and how to get beyond this challenge.

We're Here to Help Virtually

We offer a no-cost 30-minute consultation to help answer your questions, and learn more about you, the people in your life, and what you want to achieve.