A new tax bill has passed and everyone wants to know, “How will this affect me?”

If this feels a little familiar, I will remind you that in 2017 we experienced a similar phenomenon with the passing of the Tax Cuts and Jobs Act (TCJA). Many of the sweeping tax provisions in that bill were set to expire in 2025, but with the passing of the OBBB these changes have now been made permanent.

There have also been some notable new deductions added that can impact taxpayers who buy a new car, earn tips, work overtime, donate to charity, and those aged 65+. But before you get too excited, keep in mind that these new deductions are subject to adjusted gross income (AGI) phaseouts. (More on that later.)

This article is going to highlight key points to think about going into the 2025 tax season and summarize how the bill may affect you. Keep in mind that this bill is over 1,110 pages long, and some provisions are awaiting further clarification from the Treasury and IRS. We intend to keep our clients and followers informed as we learn more.

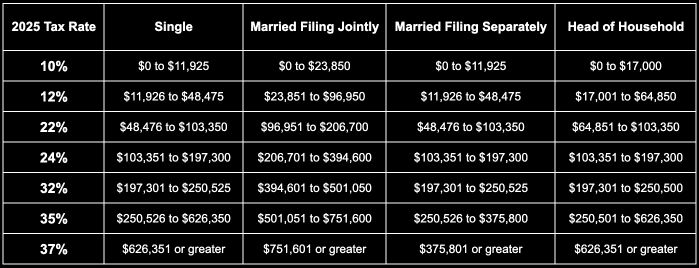

Tax Brackets

As a reminder, the TCJA introduced new income tax brackets for individuals. The highest bracket was reduced to 37% from 39.6%. These changes were set to expire in 2025. With the OBBB these lowered brackets are now permanent.

Here are the tax brackets for 2025.

State and Local Taxes (SALT) Cap

One of the most meaningful changes in the OBBB is the significant increase to the SALT deduction cap.

Prior to the 2017 TCJA, taxpayers could deduct 100% of their State and Local Taxes, uncapped. The TCJA capped this deduction at $10,000. As a result, many taxpayers who previously itemized their deductions were forced into electing the standard deduction. A side-effect was that taxpayers were no longer receiving a tax break for commonly itemized deductions, such as charitable giving and medical expenses.

With the OBBB, this cap is now being raised to $40,000. What this will inevitably do is push more taxpayers who own homes, those in high income tax states, and landowners back to using the itemized deduction instead of the standard deduction.

This limit does phase out as income exceeds 250k for single filers and 500k for married filers. There are certain tax planning strategies that can be used to prepay property taxes, lump taxes with high charity years, and more. This provision is in place until 2030.

Miscellaneous Itemized Deductions

These went away with the TCJA and this was made permanent with the OBBB, with some new exceptions. Educator expenses, including coaching and administrative expenses, are now allowed to be included in itemized deductions (over $300).

Qualified Business Income (QBI) Deduction

The 20% QBI deduction was a part of the TCJA. This has stayed on as a permanent deduction for business owners.

New Below-the-Line Deductions

The OBBB introduced several new below-the-line deductions that may reduce your taxable income, but whether or not you qualify for these deductions will depend on your adjusted gross income (AGI). If your AGI is above the phaseout threshold, you may only be able to claim a portion the total tax deduction. If your income is high enough, you won’t qualify for the deduction at all. Below are some of the more notable additions.

Auto Loan Interest Deduction

Taxpayers can receive a deduction for auto loan interest paid throughout the year up to $10,000. To be eligible for this deduction, the vehicle must be a new vehicle, not a lease, the VIN must be provided, and the final assembly must be in the United States. This phases out at $100k income for single filers and $200k for married filers, and this deduction goes through 2028. The loan provider will produce a year-end tax form with this information.

Overtime Pay

Overtime pay will have a new line recorded on the W-2. An individual taxpayer can deduct up to $12,500, or $25,000 for married filers (you must file together to qualify, if married). This phaseout starts at 150k for single filers and 300k for married filers. You must have a social security number and overtime pay cannot include tips. This is available through 2028.

Tips

Qualified tips (recorded tips) will have a deduction of up to $25,000. Married filers must file a joint return to qualify. This was extended to include beauty services such as hair, nail, esthetics, and body/spa treatments. This phaseout starts at $150k for single filers and $300k for married filers. You must have a social security number and tips cannot include overtime pay. This is available through 2028.

Personal Exemption for Taxpayers Age 65+

In addition to the standard deduction or itemized deduction, taxpayers age 65 or older will receive another $6,000 deduction for single filers and $12,000 for married filers (you must file together to qualify, if married). The phaseout for this deduction is $75k for single filers and $150k for married filers. This is available through 2028.

Partial Deduction for Charitable Contributions

This was last seen in 2021 with a maximum of $300 for single filers and a $600 deduction for married filers. You do not need to itemize to get this deduction. It has been raised to $1,000 for single filers and $2,000 for married filers. This does not start until 2026.

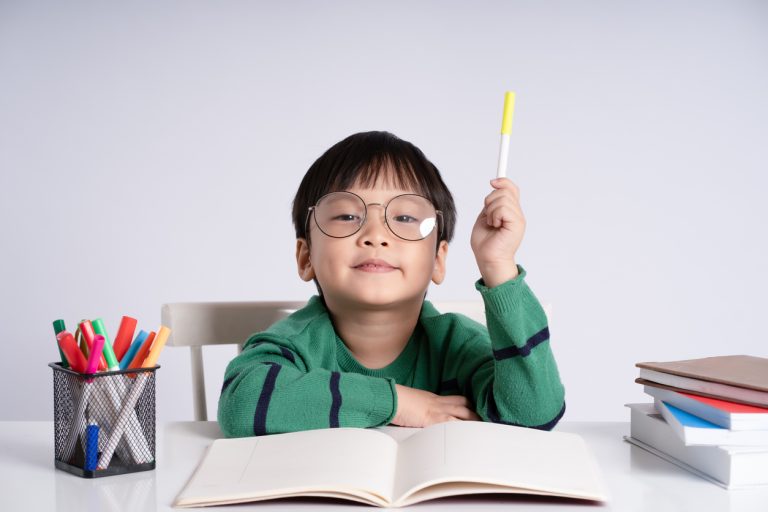

Child Tax Credit and Dependent Care Credit

The Child Tax Credit has been bumped up to $2,200 for every dependent under 17 years of age. This will also go up with inflation. The phaseout for this credit is $200k for single filers and $400k for married filers.

The Dependent Care Credit has gone up in both the rate (50% max from 35%) and the phaseout from over $43k to over $103k for single and $206k for married filers.

At least one parent and the child must have a social security number to qualify for these credits.

529 Expenses

529 plans are now able to be used for elementary and secondary education. This includes tuition, books and other expenses up to $20,000. Additional new uses for 529 plan funds include homeschooling expenses and coverage for attaining certain professional credentials and certifications. This includes materials for exams, exam fees, and classes.

Other Changes of Note:

- A 15-million-dollar estate exemption with portability (passes to your spouse).

- Research and development (R&D) expenses for businesses in the United States are fully deductible.

- Businesses can once again recognize 100% of depreciation within the first year.

- Clean Energy credits for vehicles and homes expire in 2025.

- New government-created retirement savings accounts for children born between 2025-2028.

- Gambling losses up to 90% of winnings starting in 2026.

- Business credit for paid family and medical leave for business owners.