Retirement Strategies for Young Adults

Retirement might feel far off, but starting early can make a huge difference. Learn practical savings tips, account options, and investment strategies tailored for young adults looking to build a strong financial future.

The Yield Curve Explained: How It Predicts Economic Trends and Market Moves

Is a recession coming? The yield curve has a history of predicting economic shifts—learn what its shape says about the future. Discover how it could impact your investments and what moves you should make next!

The Sequence of Returns and How It Can Change Your Life

Market volatility can negatively impact new retirees more than any other investor group. Let’s discuss ways to preserve your portfolio during the early distribution phase of retirement.

What About My Retirement Accounts?: Tax Efficient Charitable Giving Strategies Part 3 of 3

Tax-deferred accounts are popular tools to save for retirement, but for some retirees, these accounts come with a new challenge—Required Minimum Distributions (RMDs).

Maximizing the Benefit: Tax Efficient Charitable Giving Strategies Part 2 of 3

This part of our charitable giving series will focus on maximizing the amount your charity receives while also maximizing your tax benefits. We’ll discuss donating appreciated assets and leveraging Donor-Advised Funds for greater impact.

Laying the Groundwork: Tax Efficient Charitable Giving Strategies Part 1 of 3

Imagine a way to support your favorite charities while also cutting your tax bill. Sounds perfect, right? Before diving into specific strategies, it’s crucial to understand two essential concepts.

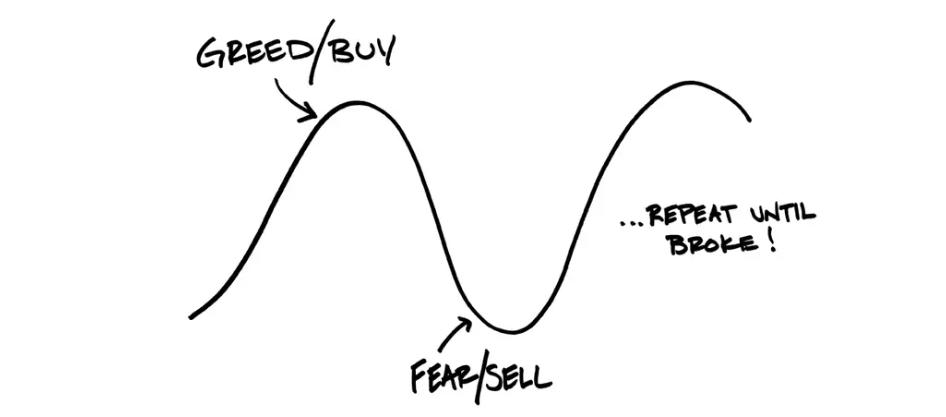

Emotionally Intelligent Investing

Most investors, even professionals, woefully underperform the indexes. Ironically, attempts to “beat the market” sabotage long-term results, driven not by analytical errors but by emotional ones. Fortunately, strategies exist to both sidestep these pitfalls and leverage them to your advantage.

Striking Balance in the Risk Equation

Whether you’re a retiree enjoying the fruits of your labor or a business owner steering through the complexities of entrepreneurship, risk affects us all, and it’s crucial to find the balance between emotional resilience and financial stability.

When Markets Give You Lemons: Tax-Loss Harvesting

We’ve all heard the saying, “When life gives you lemons, make lemonade.” That same attitude can serve investors well when managing their non-retirement investment portfolios. Naturally, investors tend to place a lot of their efforts on maximizing returns but often fail to pick up the “low-hanging fruit” that can increase their net returns after taxes. […]